HMRC Crypto Tax Guidance: What It Means for You

Posted: July 11, 2025

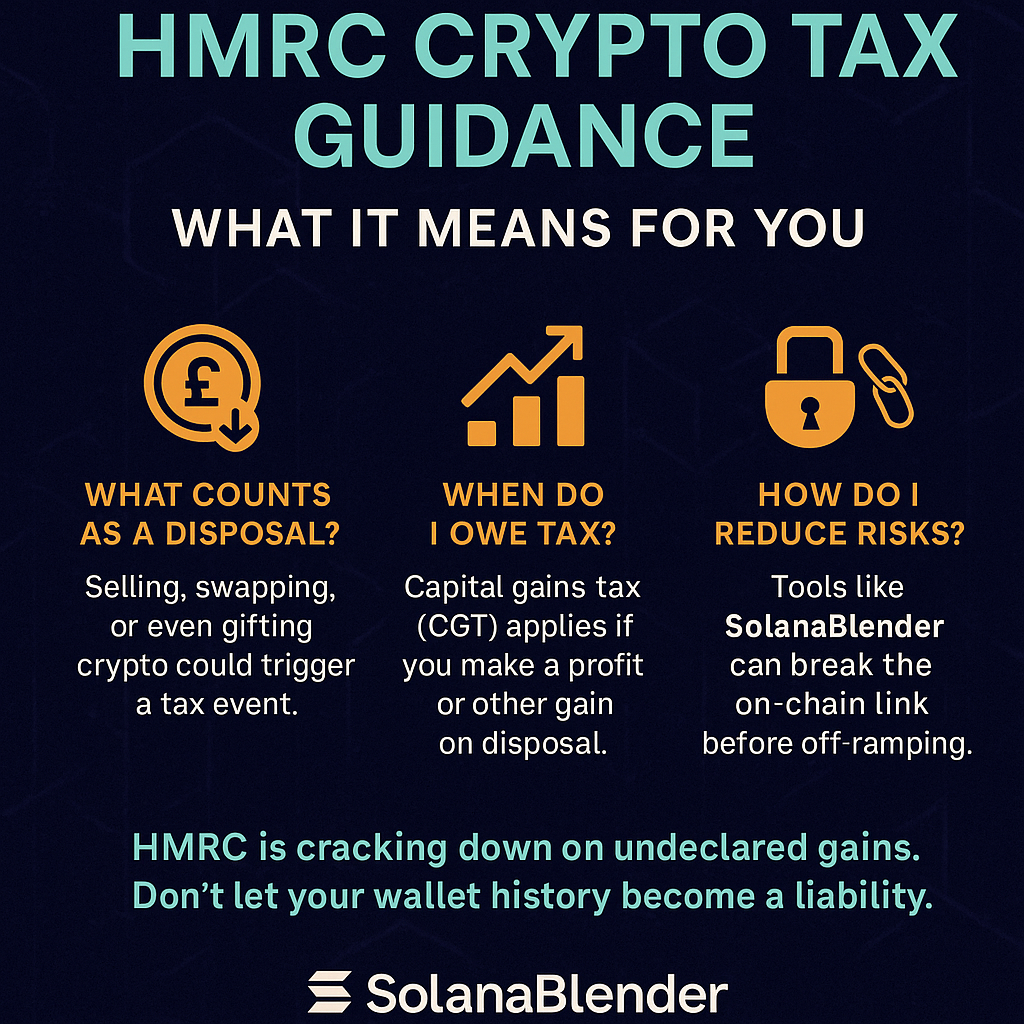

UK crypto holders recently received a nudge from HMRC with updated guidance on cryptoasset taxation. If you received that letter, you're not alone — and it's worth understanding what it means.

📉 What Triggers Capital Gains Tax?

HMRC treats most cryptoasset transactions as disposals. That includes:

- Selling crypto for GBP or another fiat currency

- Swapping one cryptoasset for another (e.g. ETH → SOL)

- Using crypto to purchase goods or services

- Gifting crypto to anyone except a spouse or civil partner

Each of these can generate a taxable gain, even if you never "cashed out" to fiat.

💼 What About Income Tax?

In some cases, especially with staking, lending, or earning crypto via work or services, income tax — not just capital gains — may apply. It's a complex space, and HMRC encourages using an advisor.

🔍 Why It Matters for Privacy

Even if you're fully compliant, crypto taxes reveal just how traceable your activity is:

- Swaps and transfers are forever recorded on-chain

- Centralized exchanges often report directly to HMRC

- Analytics firms link wallets using timing, behavior, and metadata

Privacy isn't about hiding — it's about limiting exposure. Tools like SolanaBlender can help users de-link prior wallet histories, especially when preparing to consolidate or off-ramp funds.

✅ Stay Compliant, Stay Private

There's no conflict between privacy and tax compliance. In fact, they go hand-in-hand when approached intelligently:

- Disclose taxable gains honestly

- Break deterministic transaction chains with wallet rotation

- Use privacy tools to reduce surveillance, not obligations

SolanaBlender helps users start fresh on-chain, without rewriting the past — just unlinking it. That’s not evasion. It’s good OpSec.

HMRC may never forget, but your wallet doesn’t have to remind them of every transaction you've ever made.

Written by the SolanaBlender team — empowering compliant privacy for responsible crypto users in the UK and beyond.

SolanaBlender

SolanaBlender